We Are Committed

Access Health CT has an opportunity to drive change in the diversification of the broker community in the State of Connecticut, with the potential to reduce the disparity between historically underserved communities and those that are well served by the insurance broker community. The Broker Academy Program will create a pathway for new licensed insurance brokers by recruiting from, and building the skillset of, those who live and work in underserved communities throughout Connecticut.

Applications Open Now!

Application Deadline Extended thru April, Apply Now!! Limited spaces remain!!

The Broker Academy provides free training for selected students to become licensed brokers and covers the costs of their licensing exam. The Program aims to help reduce health disparities and uninsured rates by embedding a network of trusted healthcare coverage advisors in Connecticut’s traditionally hardest-to-reach communities.

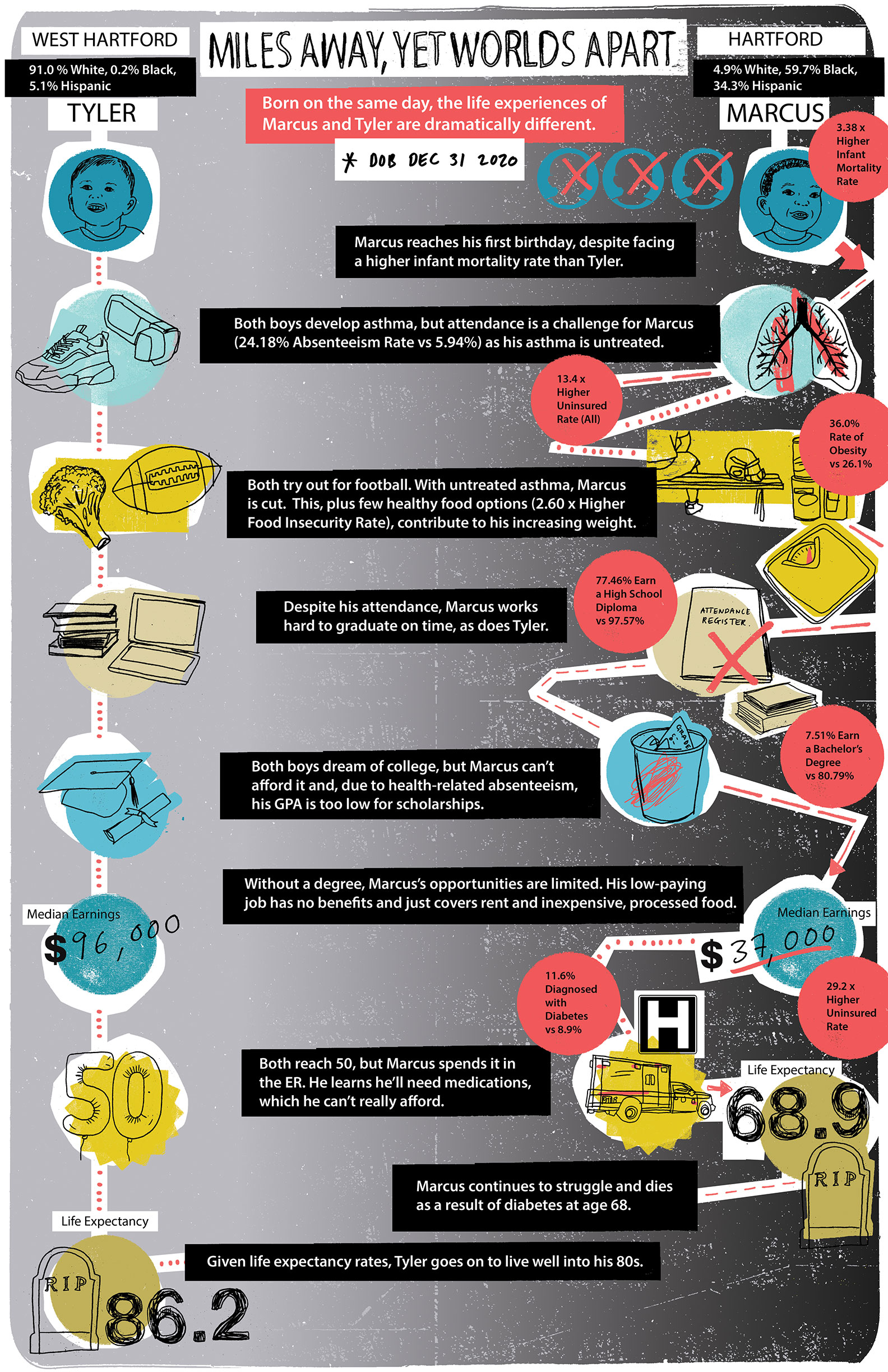

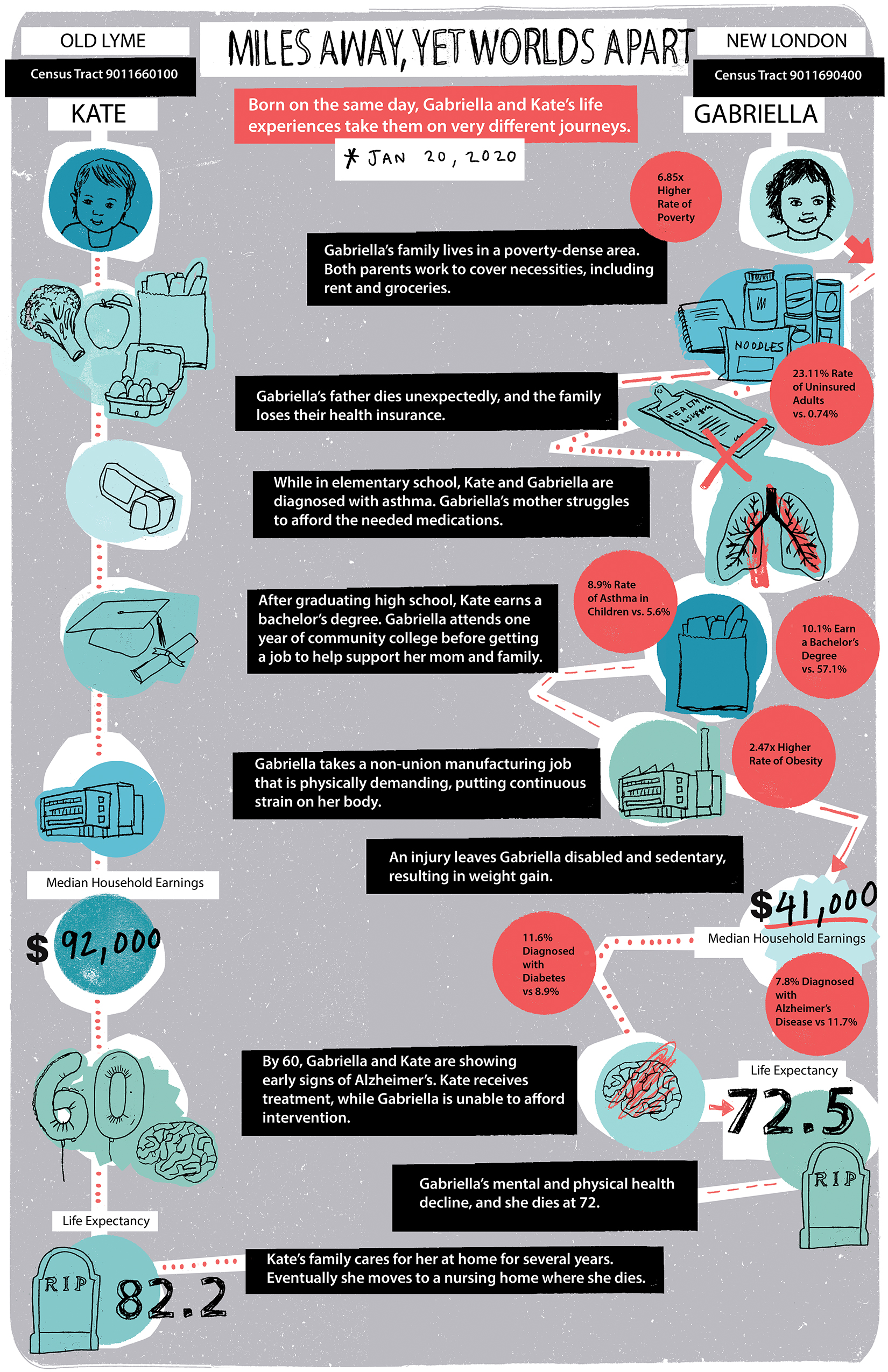

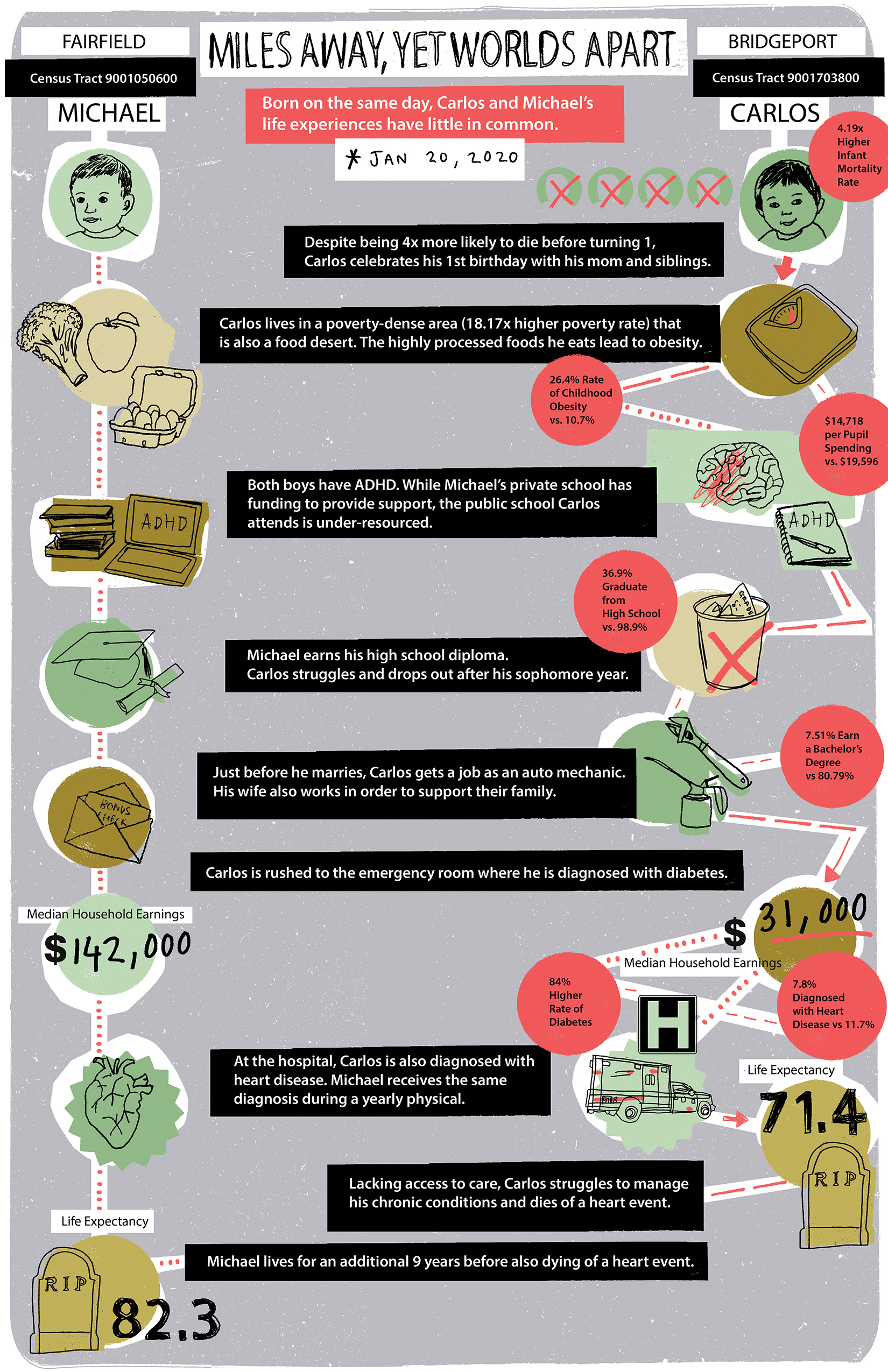

As you can see from the illustrations below, substantial disparities exist in the health status of-and in the healthcare delivered to-lower-income Connecticut residents. Particularly among people of color. The Program aims to help reduce health disparities and uninsured rates by embedding a network of trusted healthcare coverage advisors in Connecticut’s traditionally hardest-to-reach communities.

Thank You to Our Funders!

The Broker Academy is made possible in part by generous grants from the Connecticut Health Foundation, Fairfield County’s Community Foundation, Farmington Bank Community Foundation, the Community Chest of New Britain and Berlin, and the Community Foundation of Eastern Connecticut. We are grateful for their support.

State approved Life & Health Insurance Pre-licensing training provided by:

Completing the Kaplan licensing education course and passing your state licensing exam creates a solid foundation for your insurance sales career. The Kaplan Insurance Accelerator takes you to the next phase of your professional development. The Insurance Accelerator is an asynchronous course designed to teach you the activities an agent needs to perform on a daily, weekly, and monthly basis in order to operate a successful Insurance business.

To apply for the program, candidates must meet the following requirements:

- Applicants must be 18 years or older

- Show proof of GED, High School/College Diploma

- 1-3 letters of recommendation references

- Personal Statement: Why you would be a good fit for this program

- Demonstrated history of community involvement or service, communication skills, and customer service skills (resume)

- Qualified applicants will be interviewed by Access Health CT to determine acceptance into the Academy.

Applications Open Now!

Application Deadline Extended thru April, Apply Now!! Limited spaces remain!!

Applications Open Now!

Application Deadline Extended thru April, Apply Now!! Limited spaces remain!!

Pre-Training meetings

Participate in a Zoom weekly

Training

Class dates are June 3-7, 2024. Students will have the opportunity to self-study before taking the state exam.

Mentorship

After licensing, students will be matched with an experienced Broker.

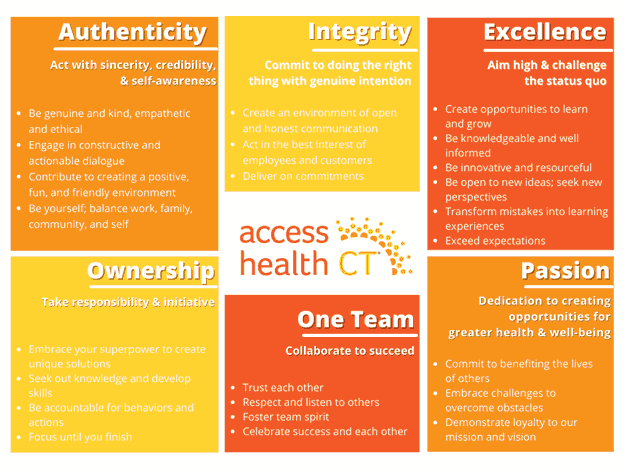

Our Values in Action

At Access Health CT, with our customers and our employees in mind, we seek to promote the collective values listed below and to live by these behaviors. Our culture of acceptance welcomes and values everyone. We challenge the status quo to find new ways to grow and improve our community, our company, and ourselves. Our people take pride in the service we provide, and in the spirit of the common good that we share.

Access Health CT Virtual Webinars

Access Health CT is offering free, virtual webinars.* For “Broker Academy Info Sessions”

* Note, these are optional events; you are welcome to start your application today!

For questions, email us at: AHCT.BrokerAcademy@ct.gov

Frequently Asked Questions

Do you have a flyer?

Do you have a timeline for accepted students?

What are some of the responsibilities and duties for a broker?

A Broker performs many different tasks.

Assess Customer Needs

The Broker must be familiar with the healthcare industry, knowledgeable about the health insurance plans available on the market, able to answer customers’ questions about the existing or potential new health insurance plans, and able to advise customers and guide them toward a health plan that fits their needs. It is critical that the Broker be able to discuss offerings articulately and accurately. Brokers are required to continually update their knowledge through training and educational programs and be up to date with new offerings.

Provide Customer Service

Providing excellent customer service is integral to the Broker role. Brokers are often responsible for creating and maintaining potential customer and client relationships, which includes documenting and supporting comprehensive customer information/a client book of record. Brokers must work to maintain these relationships by continually assessing customer needs, identifying concerns, recommending solutions, and following up regularly. The Broker will also collaborate with internal and external teams to provide input and recommendations for the improvement of the customer experience.

Execute Sales

A Broker’s goal is to successfully enroll individuals to a health insurance plan that fits their needs. Often, Brokers must act as a mediator between the parties, making sure that their concerns and desires are addressed.

Process Transactions

After the Broker identifies the best health insurance plan for the customer and obtains the agreement from the customer to start and complete the enrollment process, the Broker is then responsible for preparing and completing all the necessary documentation including the enrollment application. The paperwork often requires some knowledge of local and federal laws and regulations regarding the Affordable Care Act (ACA), income levels including Federal Poverty Levels (FPLs), sales, and taxation. Once the enrollment application is complete, the Broker is responsible for verifying the accuracy of the information and submitting the application for processing. The Broker must ensure that the customer is accurately charged, payments are applied correctly, and all necessary receipts and invoices are provided and filed.

What are some important skills and attributes needed to be a successful Broker?

Brokers are relationship builders who ensure customer satisfaction. They exhibit excellent interpersonal skills and are enthusiastic, persuasive, and likeable communicators. They are also highly detail-oriented and organized professionals who ensure that all aspects of the brokerage process run smoothly. They are intelligent people who learn quickly and are highly articulate.

If you want to work as a Broker, focus on the following:

- Have a people-oriented personality

- Can work well with others, actively listen, and be responsible and honest

- Have excellent communication skills, both verbal and written

- Can build relationships with customers

- Show proficiency in common computer programs, such as Microsoft Word, and Excel

- Have sales and customer service experience

- Be able to work closely with a mentor for a 3-month apprenticeship

- Be open and honest

- Be a true team player and strive to have a positive influence on others

- Be of service and make a positive impact in your community

How does a broker earn money?

The primary way an insurance broker earns income is by selling insurance policies to consumers and earning a commission from the insurance carrier. The commission is set by each insurance carrier individually and is pre-approved by the Connecticut Insurance Department. Insurance brokers earn new commissions by selling insurance policies to new consumers, and are eligible for “renewal” commissions each year if the customers renew the policies the insurance broker originally sold to them.

Is the training in-person or virtual?

The training is in-person and offered at 2 locations. Students must attend all 5 class days.

What is the difference between a Health insurance Broker and Health insurance agent?

Will the students get print or digital training materials?

What is a duration of the entire program?

The duration of the entire program is approx. 6 months with 5 days mandatory in-person for the pre-licensing certification class and 5 months for the mentorship part of the program. Hours for the mentorship program are flexible.

How many times can the pre-licensing certification test be taken?

How many times can the state exam be taken?

If the students fail the state exam, the exam can be scheduled again and retaken. There is no cap on how many times the students can take the state exam, but there is a fee for each time the exam is taken. Candidates must wait 24 hours before making an appointment to retake the exam. AHCT will cover the cost of up to two attempts at passing the state exam.

Can students re-take the state exam on the same day?

How many questions are on the pre-licensing certificate test?

How long is the state license exam?

What are the types of questions on the state license exam? (multiple-choice questions, open-ended questions, close-ended questions, probing questions)

How many questions are on the state license exam?

There are 90 questions on the Health exam.

Can the students be placed with one or more mentors?

Students will not be assigned to more than one mentor. However, depending on the circumstances, student can request placement with a different mentor.

Will the students have a choice of their mentorship placements?

What is the minimum timeframe of the mentorship?

The minimum timeframe of the mentorship is 3 hours per week for 90 days.