Tax Information for 2023 Coverage

If you or anyone in your household enrolled in a Qualified Health Plan (QHP) through Access Health CT in 2023, you will receive Form 1095-A in the mail by January 31, 2024 with information about your insurance coverage. You will receive Form 1095-A even if you did not receive financial help (Advance Premium Tax Credits (APTCs)).

See the table below to download our Frequently Asked Questions and a sample Form 1095-A.

Note: If you enrolled in a Catastrophic health plan in 2023, you will not receive Form 1095-A. Form 1095-A is only sent to individuals who enrolled in Qualified Health Plans through Access Health CT at the Bronze, Silver, Gold, and Platinum levels.

Forms you may receive:

You will receive a Form 1095-A if you or someone in your household had qualifying coverage through Access Health CT. If someone in your household had HUSKY Health (Medicaid or the Children’s Health Insurance Plan (CHIP)) coverage in 2023, they can request a form called a Form 1095-B from the Connecticut Department of Social Services (DSS). You should expect a Form 1095-C if you had coverage through your employer or through Medicare. If you have questions, please contact your employer or the Centers for Medicare and Medicaid Services (CMS).

NOTE: The IRS Form 1095-B is NO LONGER REQUIRED by federal law when preparing federal income tax returns and it will not be mailed to you automatically. However, DSS is required to make IRS Form 1095-B available upon request and consumers who need a copy of the Form can request it in one of the following ways:

- Online: portal.ct.gov/ctdss1095B

- By Phone: HUSKY Health 1095-B Information Center, 1-844-503-6871 (Mon. – Fri., 8 a.m. – 5 p.m.),

- Mail a request to: The HUSKY Health 1095-B Information Center, P.O. Box 280747, East Hartford, CT 06128-0747

Next steps after you receive Form 1095-A:

- Check the information on your Form 1095-A. Make sure the information is up to date for everyone covered under your plan. That includes your name, home address, health plan information and Advance Premium Tax Credit amounts (if applicable). If any of the information on Form 1095-A is wrong, please call us at 1-855-396-2428 (If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us with a relay operator).

- To view your Form 1095-A online, sign in to your Access Health CT account. You may need to reset your password if it’s been a while since you logged in.

- If you are locked out of your online account or if you need to create one, you must call us at 1-855-396-2428 (If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us with a relay operator).

- If you have questions about your Form 1095-A, or if you believe there is an error on your Form, please call us right away.

Important things to keep in mind about filing your taxes:

If you received Advance Premium Tax Credits (APTCs) in 2023 and you do not file your tax return with IRS Form 8962 to reconcile your APTCs, you may not be able to receive APTCs in future years until you complete Form 8962 and file it with your 2023 federal income tax return. If your filing or income information has changed since you applied for health coverage, you may have to pay back some or all of the Advance Premium Tax Credit amounts (financial help) you received. 1095-A Forms CANNOT be emailed or faxed. If you’ve misplaced your Form 1095-A, please contact our call center for assistance.

Frequently Asked Questions

1. Why do I need this information?

You need it to complete IRS Form 8962 as part of your 2023 federal income tax return, which the IRS uses to determine whether you received the correct amount of Advance Premium Tax Credits (financial help). Form 8962 can be downloaded at irs.gov. Please see a tax professional for help with completing Form 8962.

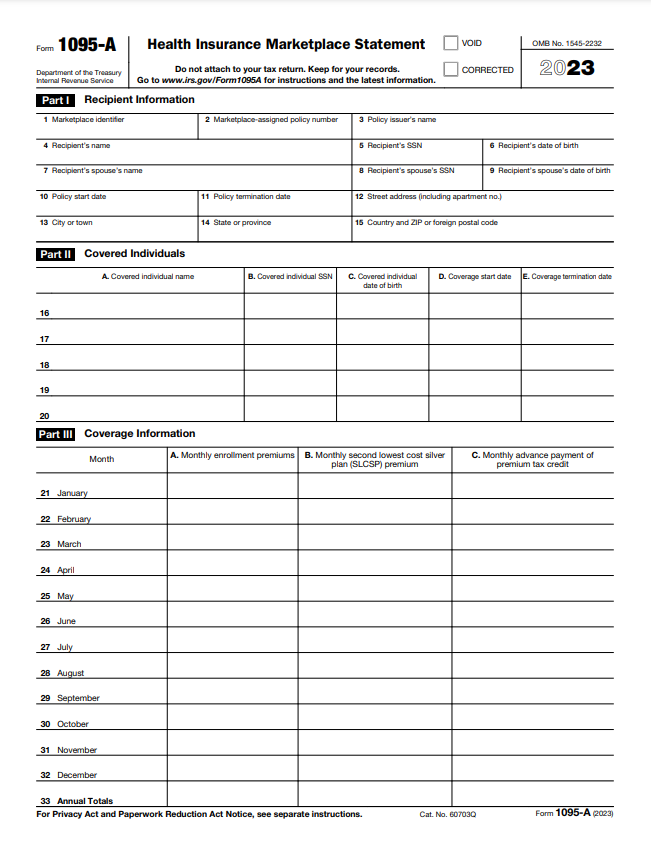

Form 1095-A shows:

- Who had qualified coverage in your household

- Your household plan information and monthly payment (known as a premium)

- The amount of money paid to your insurance company to help lower your monthly costs (known as Advance Premium Tax Credits or APTCs)

2. What should I do if my tax return was rejected for a missing Form 8962?

If you filed your federal tax return electronically and it was rejected for a missing Form 8962, you may need to resubmit your federal tax return with a completed Form 8962 or an explanation for why you are missing the form, and then attach it to the federal return when you refile. Learn how to fix it and correctly file electronically

3. I received financial help in 2023. Should I file taxes?

YES. You must file a federal income tax return for 2023—even if you usually don’t file or your income is below the level requiring you to file.

4. Could I pay a penalty?

It depends.

- For Tax Year 2023, the penalty or fee for not having health insurance coverage is $0.

- For Tax Years 2018 and earlier, individuals without coverage during those years may be subject to a penalty.

5. Why does my monthly payment (known as premium) amount on my Form 1095-A NOT match the premium amount on the bill I receive from my insurance company every month?

- The premium amount in Column A of your Form 1095-A may show an amount different than what you paid all year because amounts in Column A show only the portion of your premium that covers Essential Health Benefits.

- Plans sold through the Exchange are required to cover Essential Health Benefits.

- Insurance companies may offer benefits in addition to the Essential Health Benefits, so the premium paid may be different than the amount listed in Column A to cover these additional benefits.

6. Where is my form?

- Sign in to your Access Health CT account

- Click “Get My Tax Forms”

- Download/View your Form 1095-A

We’re here to help! If you can’t find your Form 1095-A in your account inbox, click on “Read My Messages” and then search for “1095” in the search bar, or call 1-855-396-2428 (TTY users should call 1-855-789-2428 or contact us with a relay operator).

Don’t have an online account? Click HERE to get started.

7. Additional Resources

- Second Lowest Cost Silver Plan Rates – 2023

- Second Lowest Cost Silver Plan Rates – 2022

- Second Lowest Cost Silver Plan Rates – 2021

- Second Lowest Cost Silver Plan Rates – 2020

- Lowest Cost Bronze Plan Rates – 2023

- Lowest Cost Bronze Plan Rates – 2022

- Lowest Cost Bronze Plan Rates – 2021

- Lowest Cost Bronze Plan Rates – 2020

Latest from the blog

How to Take Charge of Your Mental Health

Your mental health is just as important as your physical health. At Access Health CT (AHCT), we’re committed to helping Connecticut residents access resources to support their mental well-being. In fact, mental health services are covered by the Affordable Care Act...

Resources for Lawfully Present Immigrants

At Access Health CT, our goal is to bridge the gap in health disparities and make healthcare more accessible to more people. This may include some immigrants in the United States. If you are lawfully present in the United States and are a resident of Connecticut, you...

If You’ve Had a Recent Life Change, You May Qualify to Enroll in Health and/or Dental Coverage Outside of Open Enrollment

Access Health CT’s goal is to connect you to the best health and/or dental insurance plan for you. We do that each year starting November 1 during Open Enrollment (OE). But did you know that some people may qualify for enrollment outside of OE? If you recently...

Supporting Healthy Black Communities: Closing the Health Equity Gap

Connecticut’s population is becoming increasingly diverse. In fact, the number of Connecticut residents who identify as a person of color increased to 36.8% in 2020. It was previously 28.8% in 2010, according to the 2010 U.S. Census. Despite the increase in diversity,...